Offshore Company Formation Can Be Fun For Anyone

Table of ContentsOffshore Company Formation Things To Know Before You BuyAbout Offshore Company FormationOffshore Company Formation for DummiesThe Offshore Company Formation Statements

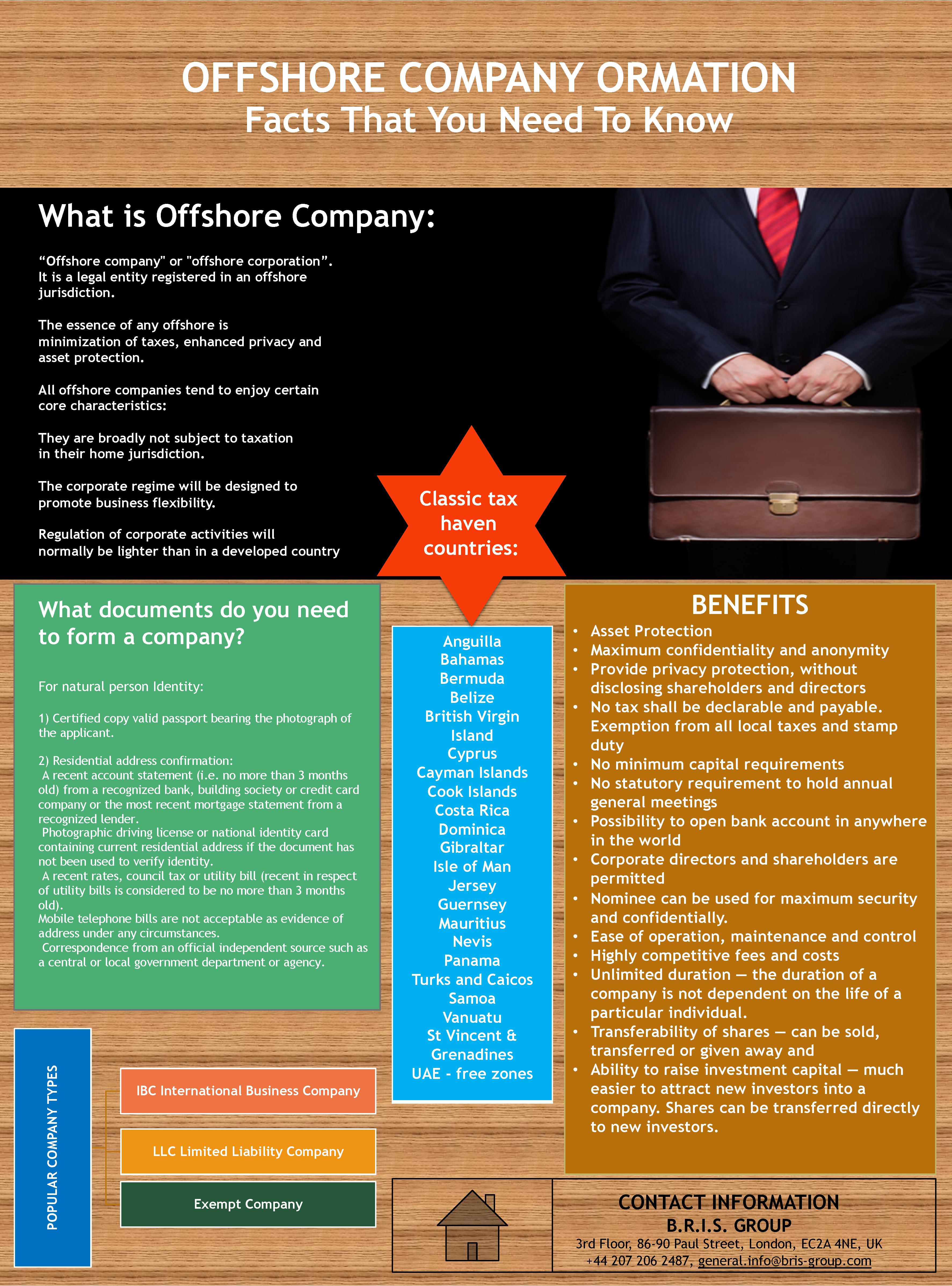

This helps guarantee business monitoring meets local regulations following preliminary establishment. Another aspect of being able to efficiently safeguard your possessions as well as handle your wide range is of training course picking the right bank account.

Setting up an offshore firm can look like a complicated possibility and that's where we can be found in. We'll direct you through the phases of company development. We're also delighted to communicate with the essential authorities as well as organisations in your place, to ensure the whole procedure is as smooth as well as seamless as possible.

The Of Offshore Company Formation

Most business-owners start at this point identifying the appropriate jurisdiction for their business. Choosing a business name isn't always as straightforward as you might believe.

This will cover a series of info, such as: details of the shares you'll be providing, the names of the business supervisor or supervisors, the names of the investors, the firm assistant (if you're intending to have one), and also what solutions you'll need, such as online offices, banking etc. The final part of the procedure is making a settlement and also there are a selection of ways to do this.

When selecting the right territory, a variety of variables need to be considered. These consist of existing political scenarios, particular compliance requirements, plus the laws and policies of the nation or state. You'll additionally require to take into consideration the following (to name a few points): The nature of your service Where you live What possessions you'll be holding Our team get on hand to help with: Making sure compliance when forming your firm Recognizing the regional regulations and also regulations Financial Interacting with the required organisations and solutions Business administration Annual revival charges connected with formation We'll aid with every aspect of the firm development procedure, no matter the territory you're running within.

Abroad firm development has actually been made efficient and also simple with the GWS Team as we offer total support in terms of technical appointment, legal examination, tax obligation advising click solutions that makes the whole process of overseas firm development smooth, without any hiccups or bottlenecks - offshore company formation. Today, a variety of overseas firms that are operating effectively around the world have actually proceeded and also availed our services and also have actually enjoyed rich advantages in the due program of time.

The Only Guide for Offshore Company Formation

An application is submitted to the Registrar of Companies with the requested name. The period for the approval of the name is 4-7 service days. When the name is accepted, the Memorandum and also Articles of Organization of the company are prepared and submitted for registration to the Registrar of Companies along with the information relating to the policemans as well as investors of the business.

The minimum number of directors is one, who can be either an individual or a legal entity. Usually navigate to this website members of our firm are appointed as nominee supervisors in order to implement the board conferences and also resolutions in Cyprus. This way monitoring and also control is made in Cyprus for tax obligation objectives.

Immigrants that do not want to look like signed up investors may appoint nominees to represent them as registered shareholders, whilst the actual possession will always relax with the non-resident helpful proprietors of the shares (offshore company formation). Our company can provide candidate investors solutions upon demand. The pop over to this site presence of the business assistant is called for by the Legislation.

The race of the secretary is unimportant it is advised the secretary of the firm to be a local in Cyprus. The Cyprus Business Regulation needs the existence of the authorized workplace of the company on the area of Cyprus. The firm preserving the IBC uses the services of a digital office with telephone, fax as well as all other appropriate facilities to aid in the administration of the IBC.

The Greatest Guide To Offshore Company Formation

The advocate's workplace is normally declared as the signed up address of the business, where fax, telephone as well as other centers are given., develop an offshore Belize business as well as set up Belize offshore bank accounts.

Development of a Belize IBC (worldwide business firms) implies no tax obligation would certainly be paid on any revenue generated by the Belize firm from abroad activity. Belize additionally has an unique tax rule for people that are resident however not domiciled there: you just pay tax obligation on earnings derived in Belize.